What does assisted suicide cost and who pays for it?

Switzerland is known for its liberal regulations on euthanasia and assisted suicide, but also for high prices and expensive services. In this text, we explain the main procedures and associated costs of assisted suicide.

Errors in the will – Is my will still valid?

The will is written and the required arrangements were made. But on opening the will, it turns out that there are various errors. Is the Will still valid? Learn what the most common mistakes are and how they affect a will.

Preparing for the event of death: How to relieve the burden on your relatives

No one likes thinking about death. And no one likes preparing for death either. But to ease the burden on survivors, it makes sense to keep certain documents accessible and to make some arrangements.

Which donations are tax-deductible?

Donate money and save taxes at the same time? You can. But not every donation qualifies for a tax deduction. In this article you will learn what is important.

Drafting a Will as a Swiss National Living Abroad

Writing a will raises many questions. Even more questions are probably asked by Swiss nationals abroad who want to draw up their will in accordance with Swiss law. Find out what Swiss Nationals Abroad should know when writing a will.

Recognition of a marriage contracted abroad

A marriage abroad is not immediately valid in Switzerland. Swiss authorities need to authenticate the marriage. This article explains the recognition of a marriage contracted abroad.

Marriage for everyone: same-sex marriage and its legal consequences

The law came into force as of 1 July 2022 after adoption of the “Marriage for everyone” referendum bill. This means that same-sex couples can now marry. In this article, we will highlight what this changes for family planning and provision.

Intestate and testamentary succession – who inherits how much?

When someone dies, there are often difficult questions regarding the estate of the deceased. In addition to will, intestate succession can help to clarify these.

What are the statutory shares of my children? Are there alternatives?

The descendants of every testator are entitled to a statutory entitlement, which in principle may not be withdrawn from them. In this text we explain what this means for your will and what alternative solutions there are.

Statutory entitlement in law of succession

Swiss law not only determines who the heirs of a person are, it also stipulates the share of the estate to which the heirs are usually entitled. In order to determine the legal succession, Swiss law uses a parentelic system.

What is a bequest (legacy)?

In certain cases, you might not want to make someone an heir, but pass a donation from your estate on to them without obligations. A bequest, also called a legacy, is a good choice for the recipient as an uncomplicated benefit.

What is a matrimonial property regime? Joint ownership of acquired property, joint property, and separation of property

Swiss matrimonial law speaks of “ordinary” and “extraordinary” matrimonial property regimes… but just what is a matrimonial property regime? Which matrimonial property regimes are there, and how far can you adjust them with a marriage contract? This article will give you an overview and explain the three matrimonial property regimes: joint ownership of acquired property, […]

Taxes after death – what tax demands ensue after someone dies?

For heirs, tax consequences after someone dies are often unexpected – whether these are the deceased’s tax debts as of the date of death or the tax demands of the tax office toward the heirs. It can be helpful to clarify the financial circumstances in advance.

Set up a charitable foundation

There are around 13,400 charitable foundations in Switzerland. Their aims are just as diverse as the people and organisations that established them or profit from them. But what exactly is a foundation? And how can I set one up?

What to do after a death?

A death is a great burden for relatives and close persons. Right in the first few days after that, various errands have to be done. In this text we show you what to do and when after a death.

How does inheritance work?

Inheritance is a complex process. Depending on the situation when the testator passes away, it may consist of various partial proceedings and steps.

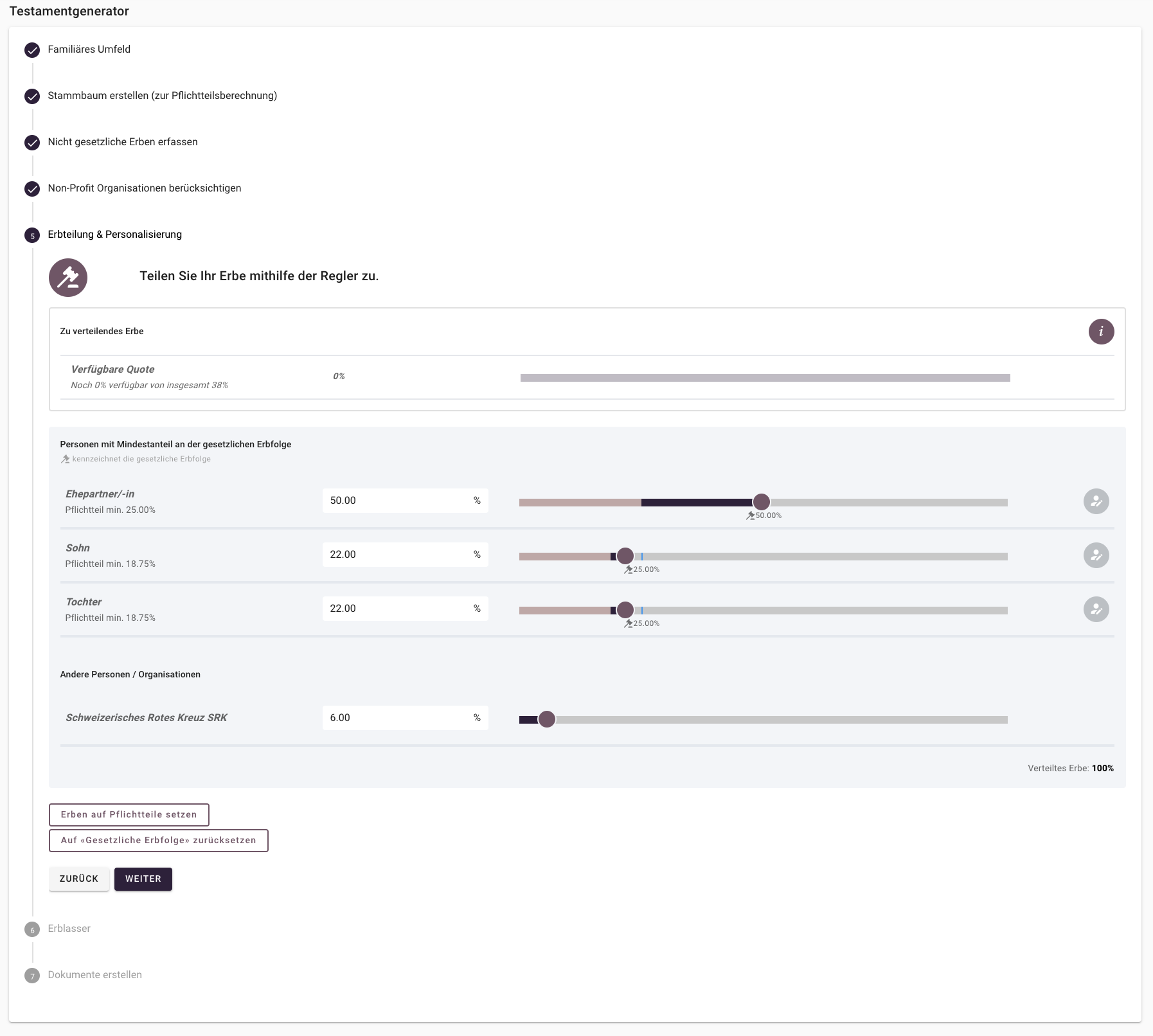

How to write my will

In the second part of our article, we show you how you can use the DeinAdieu will generator to draw up your will easily.

How do I write my will?

Drafting a will is not easy. Luckily, there are now many tools available to help you. Our testament generator is here to help. In complicated situations, however, it’s still advisable to call in specialists.

Under what conditions is euthanasia permitted?

Switzerland is known for its liberal regulations on assisted suicide. What should be permissible in this ethically sensitive area requires careful consideration. Below you will find a compilation of the framework conditions and actors on the topic of euthanasia.

What happens to internet accounts when you die?

Internet accounts are becoming an increasingly important part of our lives – but what happens to them afterwards? We will show you which precautions you can take with the ‘digital estate’ in order to handle it as smoothly as a ‘classic’ inheritance.